Finsync offers a neat variation on the theme of accountancy software in that it delivers a solution for business bookkeeping duties, but can also turn its hand to other activities too. So, alongside accounting this Georgia, US-based company offers the ability to manage payroll, cover payments both incoming and outgoing along with offering an insight into your business activities thanks to cashflow projections.

- Want to try Finsync? Check out the website here

Although these different facets of the software are separate from each other Finsync has tweaked its pricing plans, so you can enlist the services of some or all of the component parts. Or simply roll everything into one package that does it all. As a cloud-based accounting all-rounder it’s definitely showing increasing promise.

Pricing

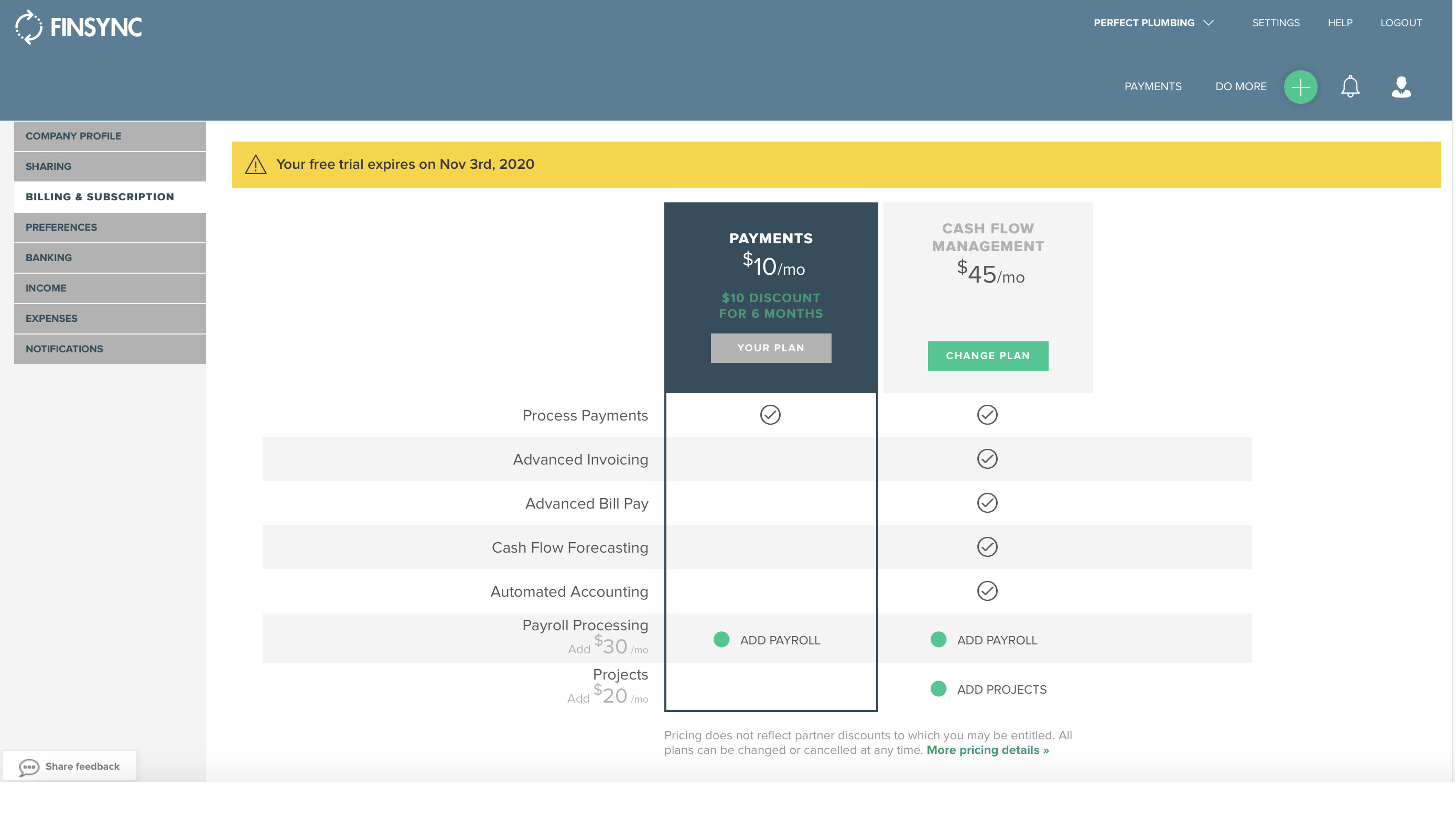

The Finsync team has come up with a way of providing just what you want by dividing what they offer into separate areas. So, if you just want something that can handle payments then there’s a dedicated Payments package that costs $10 per month (currently free for 6 months). This allows you to accept credit and debit cards, ACH payments and also process payments to anyone, via the same means.

The same goes for Payroll, which is $40 per month and lets your business tackle paying staff and contractors along with managing tax-related issues and contributions. The dynamic Accounting & Cash Flow package, meanwhile, can be had for $45 per month.

Alternatively, if your business requires all of the above then it’s worth looking at the Complete Solution. For $95 per month it covers payments, accounting, cash flow, payroll and projections too. However, payment and payroll processing fees come at an additional cost and need to be factored in. Finsync does offer a free trial of the various component parts.

Features

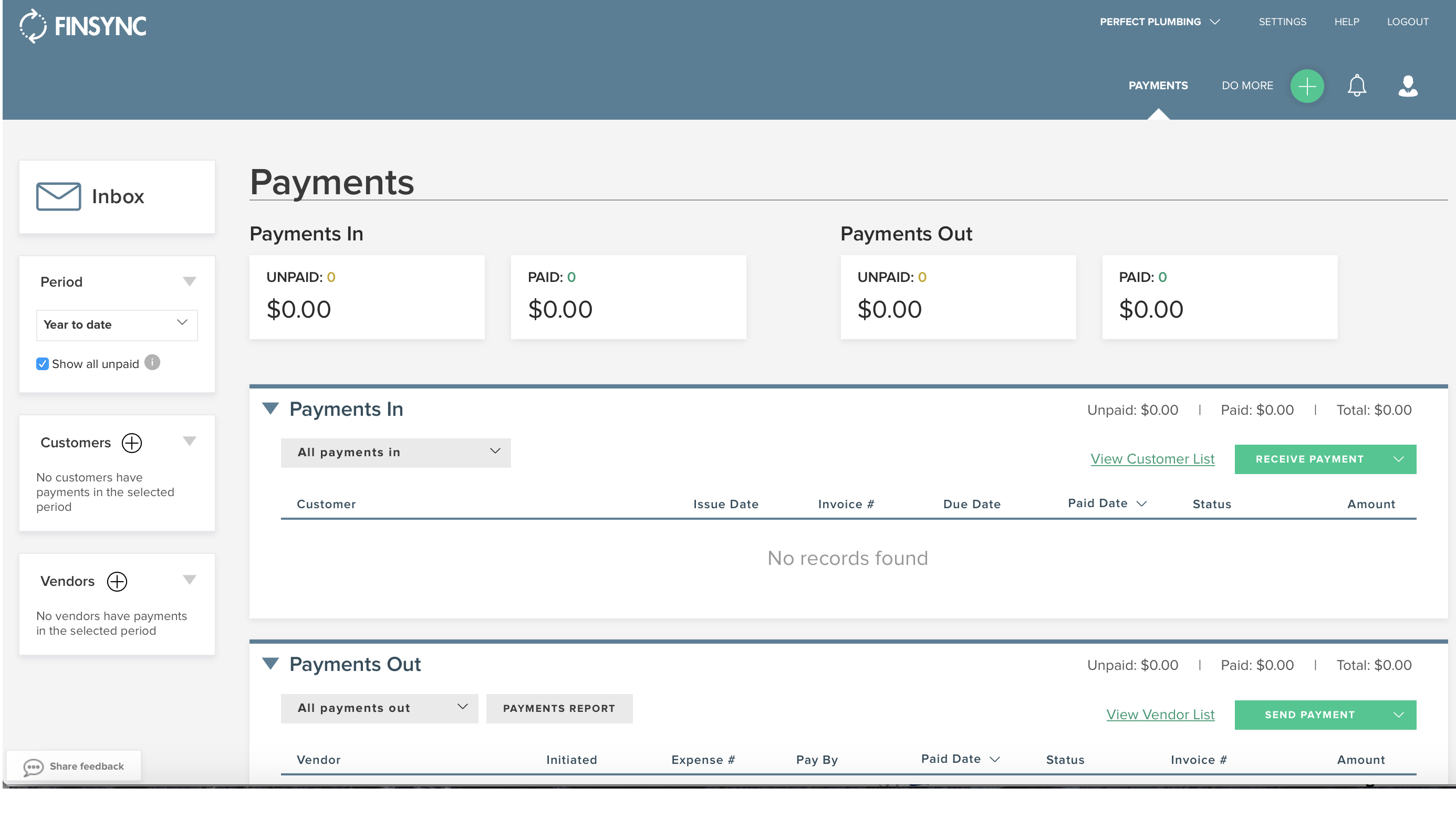

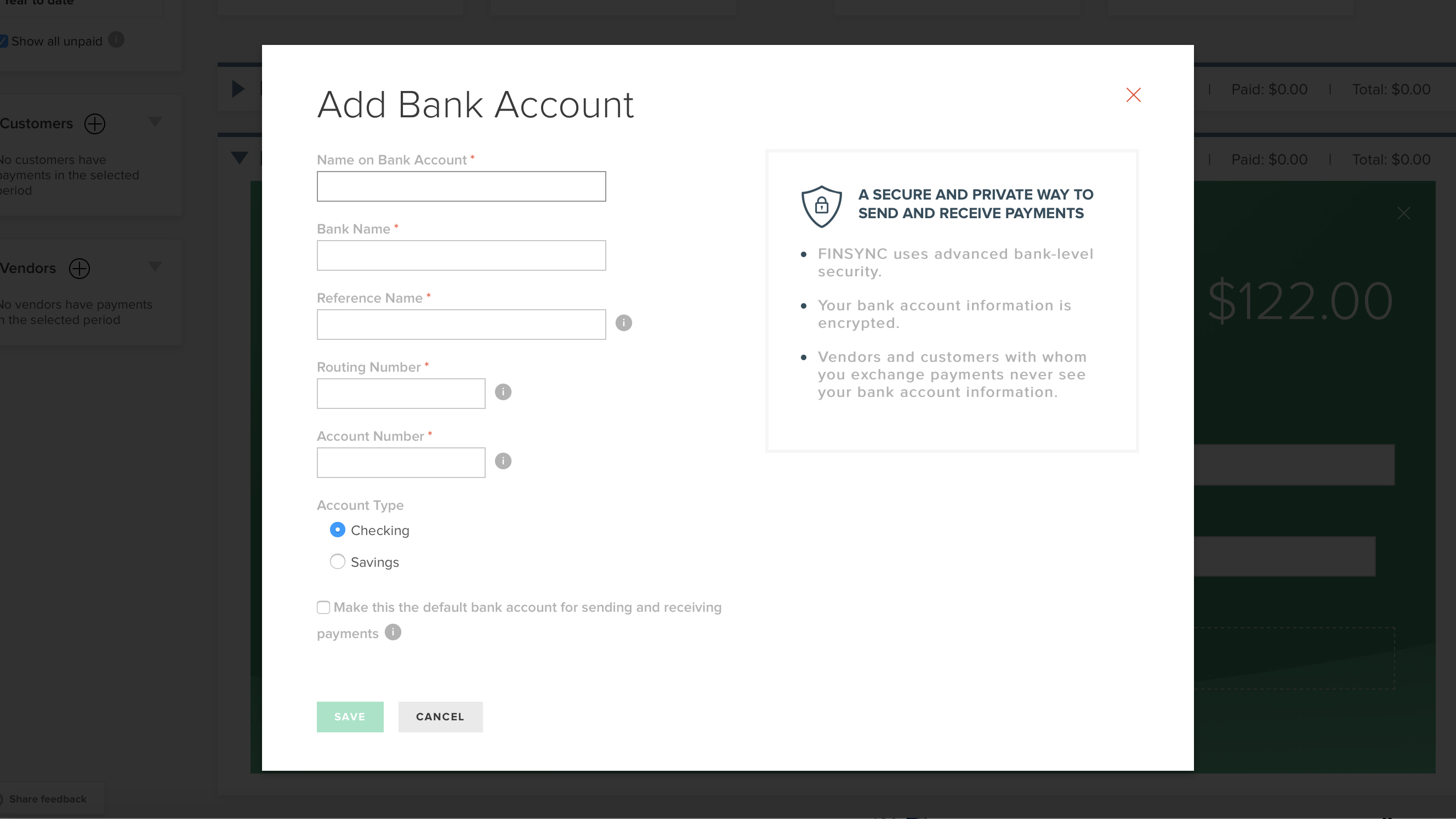

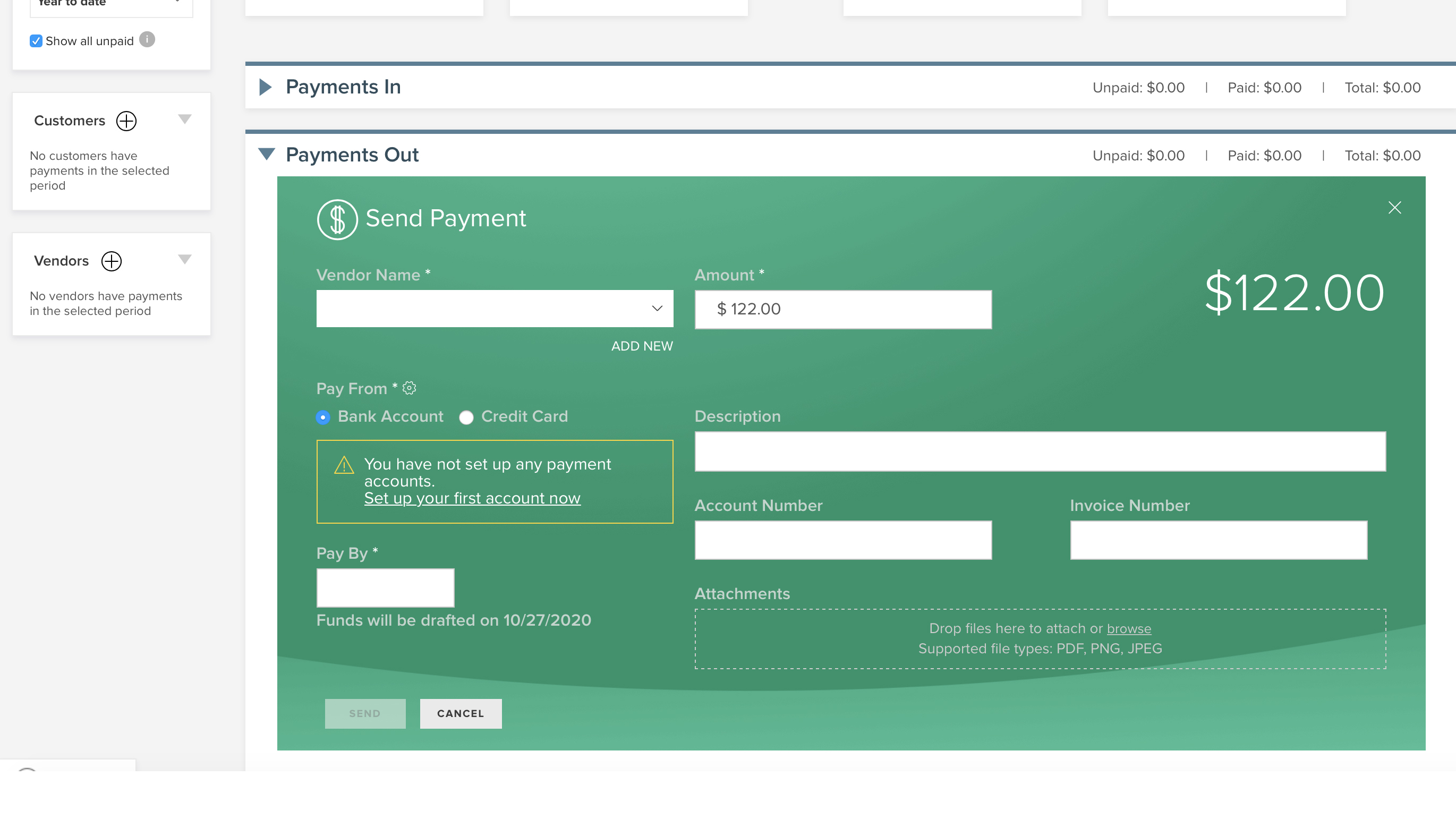

As we’ve already established, Finsync is essentially available in various component parts, with a price tag on each feature you sign up for. For example, Finsync Payments allows you to accept credit cards, debit cards and also ACH payments. You can make payments in the same way.

The Payroll option will let you process employee and contractor wages, along with managing payroll taxes and other staff associated admin. The Accounting & Cashlow aspect of Finsync is where the bulk of the features lie though, with numerous highlights. Finsync is great at cash flow management, but there’s also the ability to invoice, create estimates, track expenses, work on accounts payable and produce reports.

The big bonus here is that you can do it all with unlimited users, which makes the package an affordable option for many cash-strapped concerns. Of course, if you get the all-inclusive edition of Finsync you’ll be able to use all of the features and functions above, but combined into one single package.

Performance

This cloud-based combination of accounting and finance tools is, as you’d expect, bang up to date when it comes to running like clockwork. Finsync has developed a system that, like many others in this arena, allows you to sync with your bank or financial institution. That means you can fully automate many of your day-to-day tasks, such as accounting and payroll.

However, the additional benefit thanks to Finsync’s cash flow management tools is that you get powerful and dynamically-updated picture of your business activities. Although there’s currently no dedicated app as such, Finsync still works if you access its cloud-based setup through a browser from a mobile device.

Ease of use

As is the case with any cloud-based package, Finsync continues to evolve as the needs of its customers change. The package has already undergone dramatic improvements, with a notable update about three years ago. Since then Finsync has been tweaking and fine-tuning the service, which now features a rock-solid interface that is generally pretty easy to get to grips with.

Indeed, the various dashboard areas of Finsync mean that it’s both quick and easy to get to core areas of the package. And, even if you’re dealing with large volumes of data, the presentation is crisp and clean.

Support

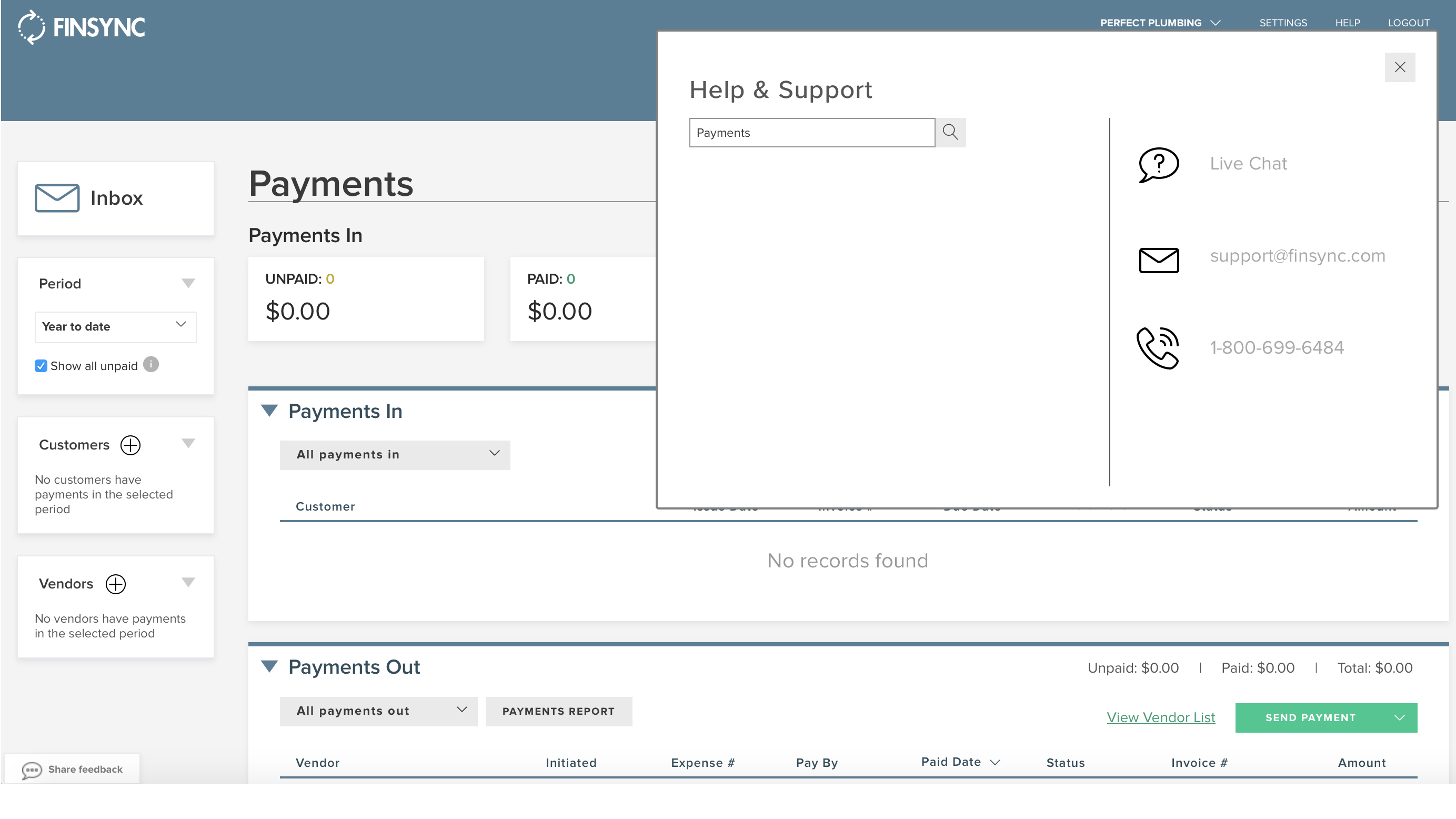

Regular users of Finsync seem in unison when it comes to praising the support aspect of the software service. Things kick off with a Finsync Knowledge Base that bristles with plenty of information and documentation on how to get the best from the package. There’s a searchable database, how-to guides, best practice tips and tricks along with news about the latest improvements to Finsync.

Subscribers to the service can also get access to support staff once they're logged in to their account with lines manned from 8 until 8 EST. Contact options include phone, email, web forms and a live chat facility covering most of the main routes for help.

Final verdict

Finsync seems like a good idea if you’re a small business that needs to handle accounting tasks as well as keep close tabs on cash flow. The ongoing coronavirus pandemic is ensuring that companies need to monitor their finances very carefully indeed, so Finsync could be a good fit for many.

As you’ll have seen from the package pricing outlined above, the costs are certainly competitive although it’s worth bearing in mind that there are additional fees to factor in. Payroll, ACH payments along with debit and credit card processing fees are just three areas where you’ll need to check those extra overheads.

Take a tour of the Finsync website though and it’s reassuringly easy to work out what extras you’ll need to pay in order to get everything up and running. Aside from that, once Finsync builds an app into its equation, this package will become a very appealing indeed.

It's also worth checking out other major players in this market such as Sage Business Cloud Accounting, QuickBooks, Xero, FreshBooks, Freeagent, GoSimpleTax, TaxCalc, Nomisma, ABC Self-Assessment, Crunch or Zoho Books.

- We've also highlighted the best accounting software

from TechRadar - All the latest technology news https://ift.tt/2TxPXo9

No comments:

Post a Comment